Accessible Banking: 10 Tips to Make Your Bank More Accessible

Published onPut Yourself in Someone Else’s Place; To Understand How They See Things

Most people who are diagnosed with a visual impairment still have some vision; they must train their eyes to see in a different manner and utilize adaptive equipment or modified text to read. Imagine having something blocking your peripheral vision, or having your central vision occluded, or looking through a piece of Swiss cheese. Imagine your eyes not being able to focus because of constant movement, or trying to see through a glass of milky water. There are many conditions that cause a person’s vision to be partially occluded, deeming them legally blind. However, many people are able to adapt and use modifications to overcome their visual deficits. Adhering to federal guidelines regarding large print is vital to many people being able to see a document or signage.

Accessible Banking Practices Tell Customers You’re Socially Responsible And You Are Looking Out For All of Your Customers

Imagine being a person who is blind or has low vision and you receive a standard bank statement. You want to reconcile your finances, but cannot do this without contacting another person to assist you. Your independence and privacy has been removed. How would that make you feel? Would you want your friends or neighbors to know your financial situation? Would you want them to know your purchases and services? It is safe to say no one would choose to give up his or her privacy and independence in this manner. However, this is a reality for some of your customers. You have the ability to give your customers independence and gain respect as a socially responsible company.

10 Tips to Make Your Bank More Accessible

1. Staff Training:

Staff training is the key to ensuring good customer service. Training allows staff to understand more about people with vision loss or impairment and teaches the staff how to best serve all clients. Training can also provide your staff confidence in communicating with people who are blind or visually impaired. You want both your clients and staff to feel comfortable and confident when doing business together. Training allows your staff to become familiar with asking people if they will require an alternative to standard print documents. Don’t assume just because a person doesn’t have a white cane, glasses and/or a seeing-eye-dog that they do not have a visual disability that requires an alternative format.

2. Policy:

Designate at least one staff member to handle the responsibility of making services accessible to people with disabilities. Once a representative is chosen, make sure to educate the rest of your staff about this person’s position and responsibilities. It’s a good idea to have this person start by developing an “accessibility policy” which can be added to your bank’s overall customer service policy. The policy should include the provision of providing information in accessible formats and how they can they be requested by customers and/or offered by staff.

3. Guide Dogs:

Try not to make assumptions. Just because someone walks into the bank with a white-cane and/or guide dog, it doesn’t necessarily mean that person is totally blind and requires braille. Many people with partial vision use guide dogs or white-canes to assist with safe mobility. Always, ask if a person requires additional assistance, never assume they need help. Also, as tempting as it can be to pet a guide dog, it’s important to remember the dog is working and is responsible for guiding your customer and should never be distracted from duty.

4. Customer Service & Teller Counters:

We recommend having a staff member offer to assist a person with a visual impairment if they are alone or with small children. The person will generally tell your staff if they require assistance or a visual guide.

If the customer asks for assistance it is best to ask, “would you like to take my (left/right) elbow?” and walk at his or her pace. You are a guide for them and the elbow allows them to follow along with you.

If you have a customer with impaired vision in line and you cannot come out to physically guide him or her to the open counter or they indicated they do not require assistance, it is best to give clear verbal assistance. Let the person know when it is their turn and where you are located. For example: “Miss, you are the next customer. I am at a raised counter about 5 paces in front of you and two steps to the right.” Then, speak to them like you would all of your clients.

5. Communication:

Always introduce yourself to people by saying your name. Customers with visual impairments may not recognize your voice and it’s impolite to expect them to guess who you are. It’s also important to always speak directly to the person instead of trying to communicate through a third party. When customers reach your counter, be sure to explain every detail of the transactions to them as information is being entered into your computer systems.

6. Forms and Documents:

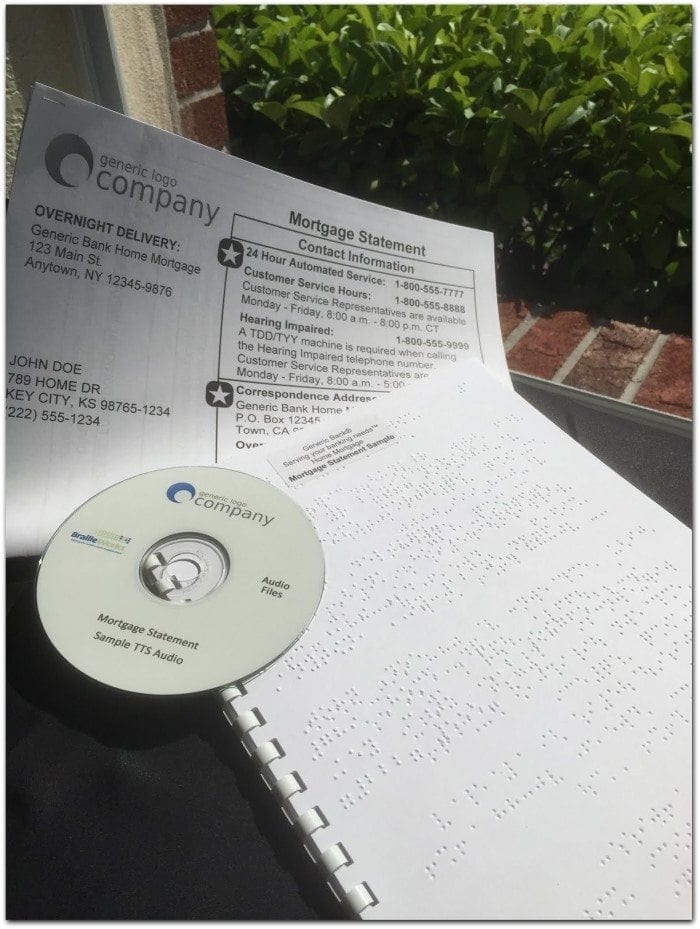

When customers with visual impairments need to complete forms or sign legal documents, the best practice is to have an alternative format available that meets your client’s needs. Alternative formats like Braille, audio and large print allow your clients to maintain their independence and put you in compliance with federal and state laws. If your company does not have all documents in an accessible format then the solution is to dedicate a knowledgeable employee to read the document to the client. It is suggested to find a quiet area that allows for maximum privacy and security of confidential and sensitive information. In matters that require fiduciary duties it is advised to have another staff member review to documents with the client to ensure that all forms are understood and filled out as the client intended.

Providing alternative formats like Braille, audio and large print will not only place your business in full compliance with the laws, but it saves your staff time and allows your clients the independence and dignity they deserve.

7. Accessible Bank Statements; Social Responsibility:

Providing your customers with an option to receive their bank statements in Braille, large print, audio or accessible PDF is following the law. Marketing that you are providing statements and documents in an alternative format shows consumers that you’re a social responsible company. Studies show people want to do business with companies that are socially responsible.

8. Deliver Dignity:

You wouldn’t send a Braille bank statement to a customer who doesn’t read Braille so why would you send a print statement to someone who doesn’t read print? As discussed in the above tips, if a client cannot read their own statements and documents they will require someone else to assist them with a basic function of independent daily living, being able to manage ones own finances. When someone is unable to manage their own matters independently a part of their dignity is lost. Imagine being able to deliver independence and dignity to your clients by providing accessible documents.

9. Transactions are Complete:

When a client is finished with their financial transaction simple steps should be followed to ensure complete satisfaction and due diligence. Ask the client if there is anything else he or she might need assistance with. Ask if help is needed in identifying paper money. Many people who have a visual impairment will fold their money in a manner that allows them to identify it by the way it is folded. Some people rely on technology and will not require additional assistance. Be certain the client has a copy of all transactions for his or her record. Scan the area to make sure all of the customer’s documents and personal items are with them. Ask if the client needs assistance leaving the office; do not assume that your help is needed. Again, if the person requests assistance, ask if they would like to take your arm. Walk at the clients pace and direct them to the door.

10. Accessible Online Banking:

Online banking is booming and continues to grow each day so having an accessible website is not only a smart business move; it meets your customers where they want to be, online and makes your company compliant with federal laws. Online banking is quickly becoming a method of choice for many people, because it may be simply faster, easier and more convenient for clients. Ensuring your website and all of your online documents comply with Section 508 accessibility standards will make all the difference to people who are blind or visually impaired. There is a difference between compliance by purchasing a program and compliance by all documents being accessible and understandable for your clients. The intention behind the law is for clients with a visual impairment to be able to access documents like a sighted person would. So, if the intention of the law isn’t the reality of your product there is a violation of ADA laws and Section 508 compliance.

If you are asking yourself, “Where do I start?” Braille Works is here for you. Allow our trained document specialist and Section 508 compliance team to assess your document compliance level, and assist your company in becoming fully compliant, while allowing the reader to understand the documents. Whether it’s accessible PDF’s for your website, audio files, large print for senior citizens, or Braille statements; we’ve got you covered. Contact our Accessible Banking and Finance Services team today to get started.

Additional Resources

Categorized in: Accessibility, Banking, Health and Wellness, Informational, News and Events

This post was written by

Comments are closed here.