ADA Compliance in Banking: Beyond the Wheelchair and Brailled ATMs

Published onIf your institution doesn’t offer services to customers with disabilities—about one in five people in the United States—then someone else will happily do it.

Jonathan Avila

In the world of banking, the Americans with Disabilities Act (ADA) requires more than just ramps, wide door-frames, and braille on signs and ATMs. ADA compliance in banking means that all aspects require accessibility for all clients, equally. Besides, what good is getting a client in the door if you don’t have accessible documents and features to meet their needs?

Who qualifies for accessible services?

Each person who interacts with your bank—whether walking through the door, calling your business, or visiting your website—is entitled to accessible services under the ADA. This doesn’t just apply to your current customers, either. Often, banks are compliant with their current clients, but not accessible to potential clients in unforeseen violations. Good intentions aren’t an acceptable excuse anymore, which can lead to fines and judgments.

The penalty for inaccessibility

Banks face hefty fines for both the first offense and subsequent violations on a per branch basis. These fines can run tens of thousands of dollars or more. This number doesn’t include personal damages which can be millions of dollars.

These fines come when individuals with disabilities are denied the right to have their banking information both private and in an accessible format. Taking away that right takes away individuals’ civil rights. This typically isn’t an intentional act, but it’s the reality of inaccessibility.

News of inaccessible companies travels fast. A few poor articles about a company’s non-compliance with federal laws compiled with consumer reviews can make or break a brand. For instance, Domino’s recently took a hit because they were in the news over an inaccessible website. Learn from others’ mistakes; it’s easier to take steps towards compliance now and avoid a penalty or ruling later.

Compliance in action

Create a plan for accessibility and stick to that plan. Having a plan and proving you follow it can prevent fines and judgments in the future. The ADA allows time to present the implementation of compliance materials; just make certain the timeline is reasonable.

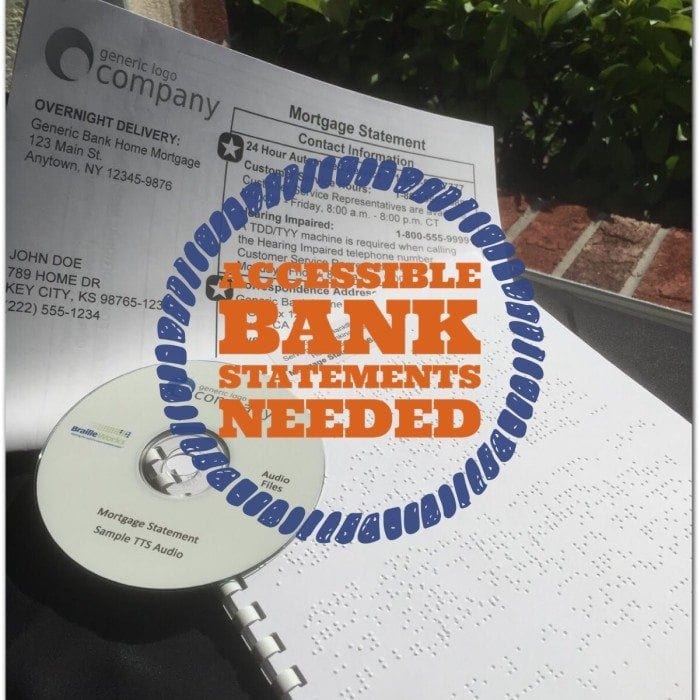

Website accessibility is especially important because it’s the easiest to catch and, therefore, the easiest to fine. It’s often advised that Section 508 and WCAG AA compliance be at the top of your accessibility plan. Next, all standard forms and documents that deal with terms and conditions of doing business with your company need to be available in an accessible format like braille. Also, you need to offer all of your clients their individual banking forms and statements in an accessible format they can read. Remember, a person’s independence and freedom to read information on their own is a civil right.

Benefits of ADA compliance in banking

People with disabilities are consumers and need your banking services. They purchase stocks, have a 401k, apply for credit cards, and need second mortgages. Also, as the population ages and people are living longer, it’s probable that more of your current customers will require accessible services like large print statements.

How can Braille Works help?

Braille Works successfully assists all industries in becoming fully compliant and has done so for over 25-years. We’re a one-stop ADA compliance shop for both online and offline document accessibility. We offer quality compliance for your website documents, audio, braille, and large print services in multiple languages. Our secure, in-house operations exceed the industry’s security standards. Plus, we have a fully operational backup facility with secure offsite document storage. There’s no job too big or too small. We welcome you to contact us today and experience the difference Braille Works can make for your company, your ADA compliance needs, and your clients.

Originally published March 8, 2016

Categorized in: Accessibility, Banking, Informational

This post was written by

Comments are closed here.